Recently, the 2025-2026 Washington State Legislative Session had a deadline of bills, leading to many getting passed or denied on the House or Senate floor for a lack or absence of votes, with each bill examined having posed different positive and negative outcomes whether passed or not.

Passed was a $3.2 billion Transportation Package

The Transportation budget currently has a $1 billion dollar shortfall and it has been predicted by the Washington State Standard as well as the overall budget shortfall by the Washington Office of Financial Management, that it will balloon to $8 billion over the course of the next 6 years.

The Washington State Senate passed the bill 31-18. The gas tax hike will take effect on July first of this year.

To close the gap in the transportation budget deficit, the transportation package of $3.2 billion will increase the gas tax from 49.4 cents to 55.4 cents.

Furthermore, it will come with a 2% increase per year to match up with inflation. It’s also not just a gas tax hike but also a diesel fuel tax hike of three cents for the 2026-2028 fiscal years

Some drivers are upset with the hike as the State currently has the 3rd highest gas price at $4.28 a gallon.

Gerry Pollet, (D) state representative for our 46th district said that while this 6-cent gas tax hike was “regressive tax”, it was necessary to get the projects done. “Well, one thing was, some of the opponents of a tax hike said, don’t finish the projects,” said Pollet. “Well, that’s not a good option at all, and not investing in bridges that will fall down, is a horrible option.”

More changes to other current and proposed transportation projects are to come, including the decision to alter toll plans for State Route 520 from just being active on the bridge to covering the entire route.

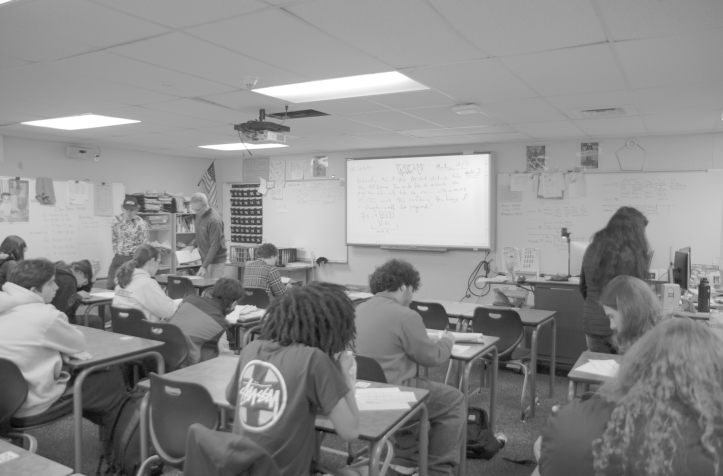

Passed was the Student’s Bill of Rights

A bill that had conflicting amendments between democrats and republicans was proposed in both the House of Representatives and Senate was passed in the Senate by a party line vote of 30 to 19.

The Student’s Bill of Rights tackles the issue of giving more students the ability to have a, “safe and supportive learning environment,” as from the concern of Senator Claire Wilson (D-Auburn)

An adopted amendment measure in the Senate discussing mental health in which it reads, “Each school district must, at least once annually, publish in a handbook, maintain on its website, or to provide to each student and the student’s parent or legal guardian, a notice that clearly identifies any medical service, mental health consulting, or behavioral health treatment.”

The bill will apply to all public schools, charter schools, and state tribal education compact schools, and this bill will expand student rights about their mental health.

In limbo is a $1.8 billion tax of the $9.2 billion tax package

House bill 2081 is controversial for the reasons that it increases taxes on thousands of businesses related to the food and hospitality industries, worrying shop owners, restaurant owners, and hoteliers.

So much so that the Washington Hospitality Association and Washington Food Industry Association have asked the Governor to veto or remove part of this bill, which if the veto were to occur, would create new problems in how to raise funding and would have the bill sent back to a vote.

Furthermore, the WHA and WFIA want the 0.5% surcharge on food and hospitality revenue tax rate for the next three years gone.

“Food is not a luxury. It is a necessity,” Anthony Anton, president and CEO of WHA wrote, “These costs will be passed on to retail operations, meaning the food you buy at your grocery store or meal you buy at a restaurant will undoubtedly increase in price.”

The surcharge will generate $1.8 billion for the next 4 years. We will just have to wait until what happens to this portion of the bill.